You need to loan capital, mortgage, buy and sell, transfer, invest, resolve disputes, divide assets or determine asset value to prove your finances to apply for a visa with real estate, but you don know exactly their value?

Let Hoang Quan Appraisal - the leading real estate appraisal organization in the market help you.

⋙ CONTACT ZALO/PHONE NUMBER: +84 934 252 707 TO RECEIVE A FEE QUOTE

Accurate appraisal of the value of the real estate is the leading factor determining the success of transactions. To ensure this, choosing a reputable real estate valuation organization is always prioritized and valued by investors, traders, and customers from individuals to organizations.

Choosing a professional appraisal company that always updates its knowledge and complies with the latest standards not only ensures transparency in the appraisal process but also provides effective support in making the right decisions when transacting real estate. Discover the most prestigious and reliable real estate appraisal service with Hoang Quan Appraisal now!

What is real estate appraisal?

Real estate appraisal is the process of determining the value of real estate at a certain time based on valuation methods and market information.

The goal of real estate appraisal is to determine its true value based on many factors, including location, area, infrastructure, current market, and other factors. The appraisal results will be used as a basis for transactions and decisions related to real estate.

Real estate appraisal are usually performed by certified appraisal experts with knowledge of the real estate market. This process requires gathering information about the property, researching the market, and using special analytical methods to come up with a number that represents the expected value of the property.

Types of real estate requiring appraisal

The market has many types of real estate that require appraisal to meet different purposes. Below are some common types of real estate that require appraisal:

-

Housing: apartments, townhouses, villas, apartments,... Social housing appraisal, housing appraisal, real estate appraisal, apartment appraisal,... . is often used for buying and selling, borrowing capital, mortgaging, or determining the value of personal assets.

-

Commercial real estate: offices, shopping centers, retail stores, warehouses, etc. Commercial real estate appraisal is often the activity of determining the income that this property can generate.

-

Land: used for commercial or residential use. The land appraisal is often based on location, area, infrastructure, and market,...

-

Construction works: includes valuation of construction projects, appraisal of the factory, valuation of industrial real estate, and civil works such as workshops, factories, power stations, infrastructure, and other projects, large construction projects,...

-

Agricultural real estate: farms, pastures, arable land, storage warehouses,...

-

Forestry real estate: forests and forest lands.

-

Adaptive reuse: urban area development projects, redevelopment projects,...

-

Real-time real estate: homestays, motels, hotels, condotels, service apartments,...

-

Public real estate: schools, hospitals, public infrastructure, parks,...

-

Special real estate: historic villas, national monuments, historical museums, private islands,...

Who needs to appraise real estate?

All individuals and organizations that need to determine the value of real estate often use real estate appraisal services.

-

Buyers and sellers of real estate.

-

Individuals need to mortgage or loan capital with real estate; land lease; proof of finances for visa application; carry out legal procedures;...

-

Real estate investor.

-

Banks, and credit institutions.

-

Insurance company.

-

Government agencies.

-

Business and government.

-

Heir or recipient.

-

Asset management organization.

-

Courts, people working in the legal field.

In addition, individuals and organizations often choose real estate appraisal services when they need to determine their true value or evaluate investment projects to know the investment potential of the properties projects and make intelligent investment decisions. Hoang Quan Appraisals business valuation service is often chosen by organizations to assess overall value.

When there is a need to pay debts or liquidate assets, individuals and organizations often use debt settlement appraisal services. In addition, when there is a need to prove finances to apply for a visa to settle down, study abroad, or travel, they also prioritize using asset appraisal services.

Purpose of real estate appraisal

Real estate appraisal is often used for the following purposes:

-

Buying, selling, and transferring: helps ensure the accurate value of real estate during price negotiation and buying and selling.

-

Finance, credit, loans, mortgages: borrowers and banks need to know the exact value of the real estate to determine loan capacity, interest rates, debt payments, mortgage value, etc.

-

Fundraising and investment: Businesses and investors need to know the current value and potential of real estate to raise funds and invest.

-

Corporate finance: determining business value; preparing annual financial reports; determining the value of investment capital; buying, selling, merging, and liquidating corporate real estate; Handling real estate when reforming state-owned enterprises.

-

Determine the rental amount: when the owner knows the real value of the real estate, they will set a reasonable rental price and establish the terms in the rental contract.

-

Proof of finances to apply for tourist, study abroad, or settlement visas: real estate appraisal helps determine the actual value of personal assets, used to prove finances and apply for a visa.

-

Legal investigation: providing important evidence to resolve legal disputes related to real estate; supporting real estate tax calculation; compensation for land clearance; inheritance, donation; divorce; determining the floor price for bidding and auctioning public real estate, auctioning real estate confiscated, transferred to the public fund,...

-

Insurance: ensures that real estate is insured for the correct value to protect the owner from risks.

Principles of real estate valuation

8 basic real estate appraisal principles often applied by professional appraisal companies include

-

The principle of highest and best use: Assessing real estate value based on the optimal and best use of the asset. If the property has the potential for better business use or ownership, the value will be higher.

-

The replacement principle: Determine real estate value based on replacement value or regeneration cost. If the property must be rebuilt, the value is equivalent to the cost of reconstruction.

-

The supply and demand principle: Considers the interaction between supply and demand in the real estate market. Values can increase or decrease based on specific supply and demand conditions.

-

The principle of change: Real estate can change in value based on factors such as new infrastructure, regional development, or changes in legal regulations.

-

The principle of anticipation/forecasting: Valuation is based on predicting the future of real estate over time.

-

The principle of suitability: Real estate value must reflect the intended use and potential future use of the asset.

-

The principle of land profitability: Value is based on the ability to earn income or profit from land use.

-

The competition Principle: Value may be affected by competition with similar properties in the area.

These principles play an important role in determining real estate value and ensuring accuracy, fairness and reliability in the appraisal process.

Real estate valuation methods

There are many real estate appraisal methods applied in determining the value of a specific real estate, including:

There are many real estate appraisal methods applied in determining the value of a specific real estate, including:

-

Comparison method: determines the value of real estate by comparing it to similar properties in the area, creating a range of values.

-

Income method: based on the expected profit or income of the property, usually applied to commercial real estate.

-

Cost method: evaluates the value by the cost of rebuilding a similar property

-

Profit method: calculates the value based on the profit before deducting operating costs

-

Surplus method: determines the remaining value of the property after depreciation and cost allocation

These real estate valuation methods can be used independently or in combination to provide a comprehensive view of the value of the real estate. The choice of a specific real estate valuation method depends on the type of real estate, the purpose of the appraisal, and the information provided by the client.

Legal documents for real estate appraisal

Real estate appraisal documents are a collection of documents and information necessary to conduct the appraisal process for a specific real estate asset. Here is a list of the types of legal documents that need to be prepared before real estate appraisal:

Real estate appraisal documents for land

-

Certificate of land use rights.

-

Notarized transfer contract.

-

Land handover decision from the State agency.

-

Extract of detailed planning map (if any).

-

Declaration of pre-tax fees.

-

Other relevant documents.

Real estate appraisal documents for leased land payable in one lump sum

-

Certificate of land use rights.

-

Building ownership certificate.

-

Construction permit (if any).

-

Estimated cost, construction settlement sheet (if any).

-

Land purchase and sale contract (if purchasing land/industrial park infrastructure).

-

Land lease contract, infrastructure purchase contract.

-

As-built drawing of the overall construction site (if any).

Land lease appraisal documents for annual payment of rent

-

Land lease contract.

-

Land allocation decision (for state-leased land).

-

Invoice for land rent payment.

-

Invoice for land rent tax payment.

Real estate appraisal documents for residential property

-

Land title deed for house, townhouse, apartment

-

Construction permit (if any).

-

Approved design drawing.

-

Purchase contract with the project developer (for apartments, condotels, officetels, etc.).

-

Extract of the detailed planning map (if any).

-

Declaration of the registration fee (if any).

-

Other relevant documents

Real estate appraisal documents for construction works

-

Building ownership certificate.

-

Construction permit, completion permit.

-

Confirmation of the project by the Peoples committee at the commune or ward level.

-

Approved design drawings and completed drawings.

-

Budget documents (if any).

-

Settlement documents (if any).

-

Construction contracts (if any).

-

Construction acceptance minutes.

-

Extract of the detailed planning map (if any).

-

Other relevant documents.

Real estate appraisal documents for investment projects

-

Land allocation decision.

-

Certificate of land use rights.

-

Investment policy decision.

-

Investment certificate.

-

Project description.

-

Current planning map.

-

Preliminary design review.

-

Construction permit.

-

Project planning drawings.

-

Feasibility report, pre-feasibility report (if any).

-

Other relevant legal documents.

Commercial and industrial real estate appraisal documents

-

Certificate of land use rights (if any).

-

Commercial/industrial property ownership certificate.

-

Land allocation decision.

-

Investment policy decision.

-

Investment certificate.

-

Construction permit/project documents.

-

Construction drawings, completion documents, and acceptance minutes.

-

Other relevant legal documents.

Real estate price determination documents need to be technically standardized and provide sufficient information to ensure the price determination process takes place accurately and reliably.

Real estate appraisal regulation

Real estate appraisal regulations are stipulated in the following legal documents:

- Law on Real estate trading 2014: Real estate valuation is a consulting activity, that determines the price of a specific real estate at a specified time.

- Circular 28/2021/TT-BTC promulgating Vietnam appraisal standard No. 11 - Real estate appraisal: regulating principles, methods, and factors affecting real estate value.

- Circular No. 145/2016/TT-BTC dated October 10, 2016, of the Ministry of Finance regulating the contents of real estate valuation:

- Real estate valuation methods.

- Order and procedures for real estate price appraisal.

- Rights and obligations of parties related to real estate valuation.

Real estate valuation process

The real estate appraisal process is a series of activities performed by an appraiser to determine the value of real estate. The real estate appraisal process at Hoang Quan Appraisal is performed according to the following steps:

Step 1: Receive request

Appraisers receive requests for real estate appraisal from customers with the following information:

-

Customers name and address.

-

Information about real estate that needs appraisal.

-

Scope of valuation.

-

Valuation method.

-

Valuation time.

-

Cost of price appraisal.

Step 2: Make a valuation plan

Appraisers create real estate valuation plans based on customer requirements with the following contents:

-

Purpose of valuation.

-

Scope of valuation.

-

Method of valuation.

-

Method of collecting information.

-

Time for appraisal.

-

Cost of price appraisal.

Step 3: Collect information

Appraisers collect information about the property to be appraised, the real estate market and similar properties. Information is collected from the following sources:

-

Secondary sources: include market research reports, websites, magazines,...

-

First source: includes information from real estate owners, related parties,...

Step 4: Analyze information

Appraisers analyze collected information to determine factors that affect the value of real estate.

Step 5: Determine the value

Appraisers use methods of valuation to determine the value of real estate.

Step 6: Prepare an appraisal report

The appraiser prepares a valuation report including the following contents:

-

Purpose of valuation.

-

Scope of valuation.

-

Method of valuation.

-

Information about real estate that needs appraisal.

-

Information about the real estate market.

-

Information about similar properties.

-

Results of valuation.

Step 7: Provide valuation report

Appraisers provide real estate appraisal reports to customers.

This complex process requires the appraiser to have specialized knowledge, experience, and skills. Appraisers must comply with legal regulations on valuation to ensure accurate and objective real estate valuation results.

Cost of real estate appraisal

Factors affecting the cost of real estate appraisal

The cost of real estate appraisal can vary depending on many factors, including:

-

Type of real estate: the value of different types of real estate will be different, so appraisal costs will also be different.

-

Purpose of valuation: appraisal costs will vary depending on the purpose of valuation.

-

Scope of valuation: the wider the scope of valuation, the higher the cost.

-

Valuation method: valuation costs will vary depending on the valuation method applied.

-

Valuation time: the longer the valuation time, the higher the cost.

-

Valuation by whom: The higher the professionalism and experience of the valuer/valuation organization, the higher the cost.

-

Special factors: environmental testing, technical testing, or special legal requirements may create additional costs.

Real estate appraisal costs will vary based on specific situations. To know the specific costs for a specific real estate valuation project, you should discuss with Appraisal companies to receive specific quotes for each project.

Costs of real estate appraisal at Hoang Quan Appraisal

Normally, costs of real estate appraisal are calculated as a percentage (%) of the market value of the real estate. Fees of real estate appraisal usually range from 1% to 5%.

This is a table of real estate appraisal costs according to the market price of real estate from Hoang Quan Appraisal:

|

Type of real estate |

The market price of the real estate |

Valuation fees |

|

Townhouses, apartments, land |

Less than 3 billion VND |

|

|

From 3 - 50 billion VND |

||

|

Over 50 billion VND |

||

|

Officetel |

Less than 2 billion VND |

|

|

From 2 - 50 billion VND |

||

|

Over 50 billion VND |

||

|

Condotel |

Less than 2 billion VND |

|

|

From 2 - 70 billion VND |

||

|

Over 70 billion VND |

||

|

Shophouse |

Less than 5 billion VND |

|

|

From 5 - 100 billion VND |

||

|

Over 100 billion VND |

||

|

Industrial property |

Less than 5 billion VND |

|

|

From 5 - 1000 billion VND |

||

|

Commercial real estate |

Less than 5 billion VND |

|

|

From 5 - 1000 billion VND |

||

|

Resort real estate |

Less than 2 billion VND |

|

|

From 2 - 70 billion VND |

||

|

Over 70 billion VND |

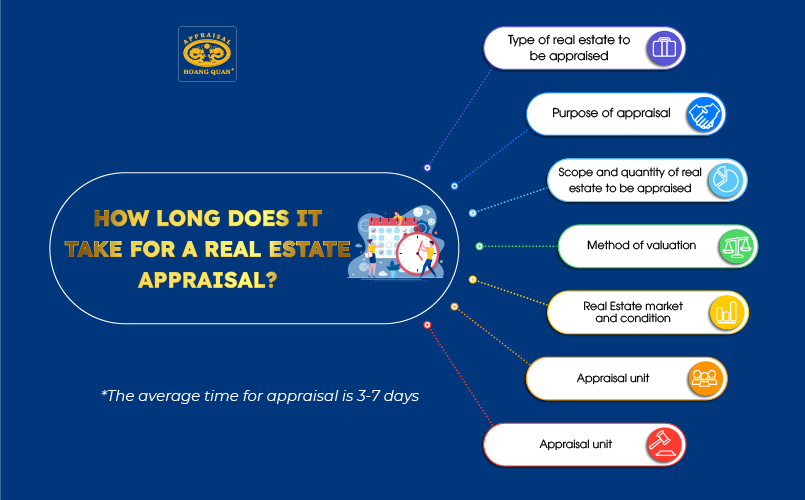

How long does it take for a real estate appraisal?

Normally, the time for real estate appraisal at Hoang Quan Appraisal will range from 3 to 7 days. However, in some situations, the appraisal time may take longer, such as in cases of specific or complex real estate appraisals.

When choosing a real estate appraisal organization, customers need to discuss with the appraisal organization about the appraisal time and choose an appraisal organization with a quick, effective and reliable appraisal time to meet your needs.

Is real estate appraisal necessary?

Real estate appraisal is an important step in real estate transactions and management. It ensures accuracy and fairness in determining the value of assets. Therefore, appraisal of the value of real estate is extremely necessary.

Valuation helps determine the actual value of real estate, the current market value, and serves as a basis for setting the appropriate price when negotiating, buying, selling, transferring or investing.

In many countries, real estate appraisal is required when a transaction arises. This ensures transparency and fairness in asset valuation, preventing fraud and legal risks. In addition, appraised value is often used in disputes related to real estate, as a basis for court decisions and to resolve legal conflicts.

When managing assets, insurance of real estate, investments, investment funds and banks often use appraisal value to evaluate the feasibility of investment projects. Local governments even use appraisal information to levy real estate taxes, ensuring tax collection is calculated correctly and fairly.

It can be said that real estate valuation is an essential and indispensable part in the real estate environment.

Is real estate valuation guaranteed to be accurate?

Real estate valuation cannot ensure 100% accuracy. The value of real estate can change over time due to many different factors, depending on the difficulty of each type of appraisal:

-

Quality of collected information: better-detailed information and market data will lead to more accurate appraisal results.

-

Methods of valuation: the comparative method often provides more approximate results when more market data is available.

-

Experience of the appraiser: an appraiser with specialized knowledge and rich experience will bring more accurate appraisal results.

-

Valuation targets: Each specific valuation goal (purchase, loan, investment,...) may require different levels of accuracy.

-

Real estate condition: the more complex the real estate, the lower the accuracy of the appraisal results.

Although absolute accuracy cannot be guaranteed, real estate appraisal is still an important tool to determine property value, providing an appraisal result that approximates the actual value of the property, and helping make decisions about buying, selling, investing, and managing real estate.

To ensure accurate real estate appraisal results, customers need to choose a reputable appraisal organization with a team of highly qualified appraisers and use appropriate appraisal methods.

What should customers pay attention to when using real estate appraisal services?

To ensure the real estate appraisal process takes place quickly and effectively, you need to:

-

Clearly define what the valuation goal is to guide the valuation process.

-

Provide detailed and accurate real estate related information to the appraiser. Inaccurate information can easily create inaccurate results.

-

Consult multiple parties to compare costs, time, appraisal methods and service quality. This helps you choose according to your own needs.

-

Choose a reputable appraiser or valuation company, has a license to operate valuation issued by the Ministry of Finance, has a website and official information channels, and is trusted and used by many customers. This means your appraisal certificate will be guaranteed in terms of quality.

-

Once the appraisal process is complete, you must read the valuation report carefully to understand the basis of the valuation and the factors that were considered.

-

If your propertys condition changes after a valuation, ask about the process for checking and updating the valuation.

By following these notes, customers will be able to choose a reputable appraisal organization and have accurate appraisal results.

Hoang Quan Appraisal - The markets leading reputable real estate appraisal organization

Real estate appraisal service is one of the competitive advantages of Hoang Quan Appraisal. With a database accumulated more than 20 years of operation, a team of highly qualified and experienced appraisers and advanced valuation methods, Hoang Quan Appraisal confidently provides customers with appraisal results. Real estate valuation is accurate and applicable to all cases.

Customers of Hoang Quan Valuation are always satisfied with the professionalism, dedication and quality service they receive. This has made us one of the leading reputable real estate valuation companies in the market.

If you are in need of a reliable real estate appraisal service, Hoang Quan Appraisal is the perfect choice to help you get accurate and reliable information to make important decisions in the field of real estate.

✔️ REAL ESTATE APPRAISAL SERVICE - HOANG QUAN APPRAISAL COMMITS:

✅ 100% free consultation, quick fee quote within 1 working hour, EXTREMELY PREFERENTIAL appraisal fee.

✅ Report and return appraisal results SUPER FAST.

✅ The certificate has high legal value according to regulations of the Ministry of Finance, used by many banks and large businesses.

✅ 100% customer information security.

Conclusion

Hoang Quan Appraisals real estate appraisal service brings certainty and professionalism. With a team of veteran appraisers and modern appraisal methods, we are committed to ensuring accuracy and reliability. Let us help you accurately assess your real estate value.

Hoang Quan Appraisal - Appraisal of true value!

Source: hqa.com.vn

⋙⋙⋙ CONTACT US NOW

HOANG QUAN APPRAISAL COMPANY LIMITED

Address: Hoang Quan Appraisal System

Phone number: 0934.252.707

Email: contact@sunvalue.vn

Facebook: Thẩm Định Giá Hoàng Quân